FSN E-Commerce Ventures Ltd., popularly known as Nykaa, has been a transformative player in India’s beauty and fashion e-commerce industry. From being a bootstrapped startup in 2012 to becoming a publicly listed unicorn, Nykaa’s journey is emblematic of the booming digital consumer economy in India.

As of July 2025, Nykaa’s stock has faced volatility due to recent block deals, investor sentiment swings, and a dynamic e-commerce landscape. Let’s take a deep dive into Nykaa’s share price performance, its financials, challenges, and what lies ahead for investors.

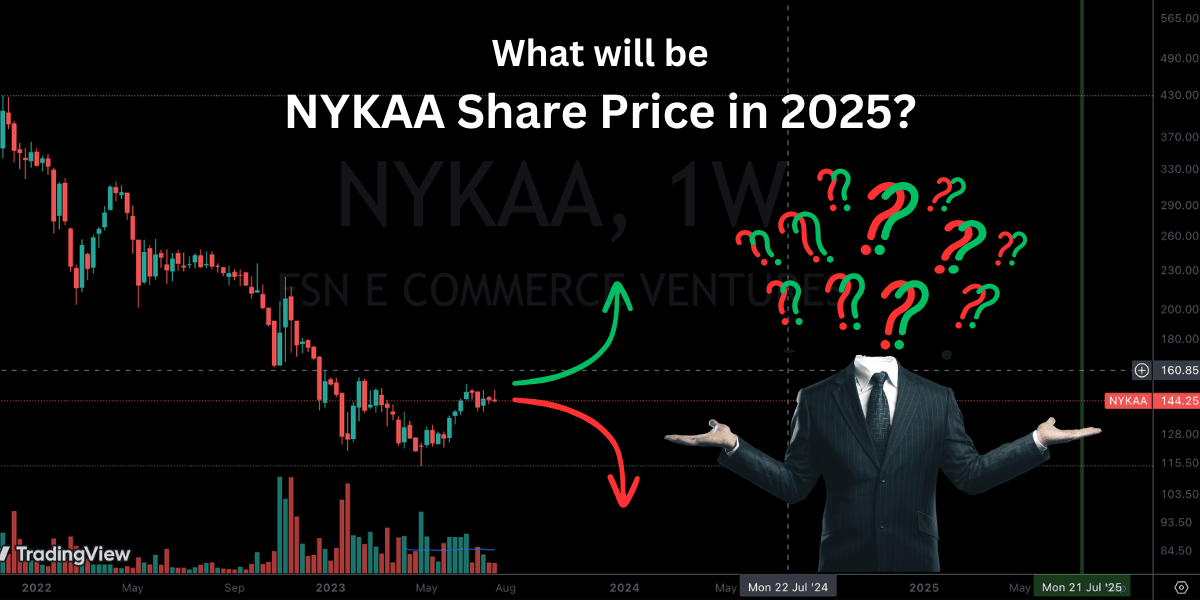

📈 Nykaa Share Price Performance (2021–2025)

It made a blockbuster debut on the Indian stock market in November 2021, listing at a premium of over 80% above its IPO price of ₹1,125. However, since then, the stock has seen considerable corrections. Here’s a quick look:

- All-time high: ₹2,574 (Nov 2021)

- 52-week high (2024–25): ₹230

- 52-week low: ₹155

- Current price (July 2025): ₹203 (NSE)

Why the decline from all-time highs?

- Valuation correction: The market re-rated many new-age tech stocks post-IPO.

- Rising competition: Players like Tata Cliq, Amazon Beauty, and Reliance’s Tira have intensified the battle.

- Profitability concerns: Nykaa, while revenue-rich, was under pressure to turn sustainably profitable.

- Investor exits: Periodic promoter and PE exits via block deals have affected stock momentum.

🛍️ Business Overview: More Than a Beauty Platform

It operates under three major segments:

- Beauty and Personal Care (BPC) – Flagship business, driving most of the revenue.

- Fashion – Through Nykaa Fashion, focusing on premium Indian and western wear.

- Other verticals – Nykaa Man, Superstore (B2B), and partnerships with global brands.

Its omnichannel model, strong influencer marketing, and curated content-led commerce set it apart.

📊 Q4 FY25 Financial Performance

Nykaa’s latest results for Q4 FY25 show a mixed picture:

- Revenue: ₹2,062 crore (+23.6% YoY, –9% QoQ)

- Gross Merchandise Value (GMV): ₹4,102 crore (+27% YoY)

- Net Profit: ₹20.3 crore (+193% YoY, –22% QoQ)

- EBITDA: ₹133 crore (+43% YoY)

- EBITDA Margin: 6.5%

Key Takeaways:

- The beauty vertical remains profitable, resilient, and high-margin.

- The fashion segment is still in the red, dragging margins.

- QoQ softness has worried short-term investors, but long-term fundamentals remain intact.

🔄 Block Deals & Investor Sentiment

In July 2025, the market saw another massive block deal where Harindarpal Singh Banga and Indra Banga reportedly sold over 60 million shares, amounting to a ~2.1% stake.

Impacts of Block Sales:

- These are secondary sales and do not affect the company’s balance sheet.

- However, they indicate early investors cashing out, leading to short-term price weakness.

- Institutional buyers often pick up such blocks at discounted prices, suggesting continued interest.

📈 Growth Strategy Ahead

Nykaa is aiming to scale while maintaining operational discipline. Here’s how:

1. Omnichannel Expansion

- Over 175 physical stores by FY26 are planned.

- Hybrid retail model gives customers a “touch and feel” experience, boosting trust.

2. Technology Investment

- AI/ML-based personalization is being deployed for better product recommendations.

- Influencer-led content and virtual try-ons enhance user engagement.

3. Private Label Expansion

- Nykaa’s own brands (Kay Beauty, Nykaa Naturals) offer higher margins.

- These labels are being expanded across skincare, wellness, and even men’s grooming.

4. International Foray

- Nykaa is testing global waters with GCC (Gulf) and Southeast Asia partnerships.

💡 Strengths of Nykaa

- First-mover advantage in organized beauty e-commerce.

- Strong brand equity among millennial and Gen Z consumers.

- Wide product selection with over 2,000+ brands.

- High engagement via social commerce (YouTube, Instagram, influencers).

- Efficient inventory-led model vs. pure marketplaces.

🚧 Risks and Challenges

Despite its strong brand, Nykaa faces the following hurdles:

1. Intense Competition

- Reliance-backed Tira is growing rapidly with deep pockets.

- Amazon, Flipkart, and Myntra are leveraging logistics and customer bases.

2. Valuation Premium

- Even after correction, Nykaa trades at high P/E multiples (600x–800x).

- Any earnings miss leads to sharp price reactions.

3. Fashion Segment Losses

- While beauty is profitable, fashion continues to bleed cash.

- Scaling without hurting margins is a tough balancing act.

4. Promoter Dilution

- Frequent stake sales by founders or early investors create perception risks.

📊 Technical View (As of July 3, 2025)

- Support level: ₹195

- Resistance: ₹215–220

- RSI: Around 42 (slightly bearish)

- Trend: Sideways to mildly negative in the short term

👩💼 Management Commentary

CEO Falguni Nayar recently emphasized that Nykaa is:

“Not focused on hyper-growth at the cost of sustainability. We want to build a profitable, trustworthy brand for the long haul.”

This highlights their long-term vision over short-term market fluctuations.

🧾 FAQs

Q1. Is Nykaa a good stock to buy now?

Ans: At ₹203, the stock has corrected from its peak. If you believe in India’s growing beauty and fashion consumption, it could be a good long-term play. Short-term risks remain.

Q2. Why did Nykaa shares fall recently?

Ans: A large promoter block deal, soft QoQ results, and general tech stock volatility led to recent declines.

Q3. What’s Nykaa’s revenue source?

Ans: 70%+ comes from the Beauty & Personal Care vertical; the rest from Fashion and other emerging segments.

Q4. Is Nykaa profitable?

Ans: Yes, in FY25 it posted consistent profits in the beauty segment. The company is EBITDA positive, but fashion losses weigh on net profits.

Q5. Does Nykaa pay dividends?

Ans: No dividend declared yet. The company reinvests earnings to fuel growth.

📝 Conclusion: Buy, Hold, or Avoid?

Nykaa is no longer the hot IPO stock it was in 2021, but that may be a good thing for long-term investors. The froth is gone, the business is maturing, and the focus is now on profitability, efficiency, and brand leadership.

✅ Buy if:

- You believe in the Indian beauty/fashion e-commerce story

- You’re investing for 3–5+ years

- You can handle volatility and don’t expect quick returns

⚠️ Avoid if:

- You want short-term gains

- You’re risk-averse to tech stock movements

- You don’t follow company fundamentals

Nykaa is building not just a business—but a brand. And brand equity, unlike market hype, is a moat that lasts.