Voltas Ltd, a Tata Group company and a household name in India’s air conditioning and engineering services industry, is at a fascinating crossroad in July 2025. While long known for its dominance in the cooling solutions space, recent market movements, regulatory challenges, and seasonal trends have made share price a hot topic among retail and institutional investors alike.

This in-depth analysis covers share price performance, financial health, recent news, and long-term investment potential.

📊 Share Price Snapshot (as of July 3, 2025)

- Current Market Price: ₹1,370 (BSE/NSE)

- 52-Week High: ₹1,946

- 52-Week Low: ₹1,172

- YTD Performance: –30% (till mid-June), but +7% in the past month

Despite a sharp correction earlier this year, the stock has recently shown signs of recovery, especially post its strong Q4 FY25 results.

🧾 What is Driving Voltas’ Recent Stock Movement?

1. Q4 FY25 Earnings Boost

Voltas’ Q4 results surprised many:

- Revenue: ₹4,847 crore (up 14% YoY)

- Profit Before Tax: ₹343 crore (up 97%)

- Net Profit: ₹236 crore (up from ₹111 crore last year)

For the full FY25:

- Revenue: ₹15,737 crore (up 24%)

- Net Profit: ₹834 crore (up 236%)

These stellar numbers reassured investors that Voltas’ fundamentals remain intact despite short-term demand fluctuations.

2. GST Show-Cause Notice of ₹265 Crore

On July 2, 2025, Voltas disclosed that it had received a Goods and Services Tax (GST) show-cause notice for an alleged tax liability of ₹265 crore. While such regulatory overhangs usually lead to investor panic, this time the market remained relatively unaffected.

Why?

- has strong legal backing and is expected to contest the claim.

- Its cash flows and balance sheet remain robust.

- Investors saw this as a one-time compliance issue, not a structural threat.

3. Seasonal Impact: Poor Summer AC Sales

This summer has been unusually cool due to unseasonal rains in April–May 2025, which significantly dented air conditioner (AC) sales:

- Industry-wide AC sales dropped 20–25% YoY.

- Voltas, being the market leader in ACs, saw an inventory pile-up and higher discounting.

However, the company has hinted that June sales showed some recovery, and Q2 could be stronger.

🧠 Understanding Business Model

Voltas operates in three key segments:

A. Unitary Cooling Products (UCP)

- Includes ACs, air coolers, commercial refrigeration

- Contributes 50–55% of revenue

- High seasonality; peak in Q1 (Apr–Jun)

B. Electro-Mechanical Projects and Services (EMPS)

- Engineering and MEP contracts for domestic and international clients

- Contributes ~30% of revenue

- Operates on long-term contract basis

C. Engineering Products and Services (EPS)

- Niche segment: mining & textile machinery

- Contributes ~10–15% of revenue

🧩 Voltas in the Competitive Landscape

It is the No.1 player in India’s AC market with a share of ~21% in split ACs.

Key competitors:

- LG, Daikin, Hitachi – premium segment

- Blue Star, Lloyd, Whirlpool – mid-range

- Samsung, Godrej, Panasonic – diversified MNC players

Recent Trend:

- Tough competition and price wars are compressing margins.

- However, Voltas’ brand equity and distribution reach keep it ahead in volume terms.

🛒 Voltas Beko: The Appliance Gamble

It has ventured into the white goods market via Beko, a JV with Arçelik (Turkey):

- Offers refrigerators, washing machines, dishwashers

- Investment-heavy and still in the loss-making stage

- Voltas’ plan is to become a full-fledged consumer durable brand, not just an AC maker

This expansion will diversify revenue but has weighed on short-term margins.

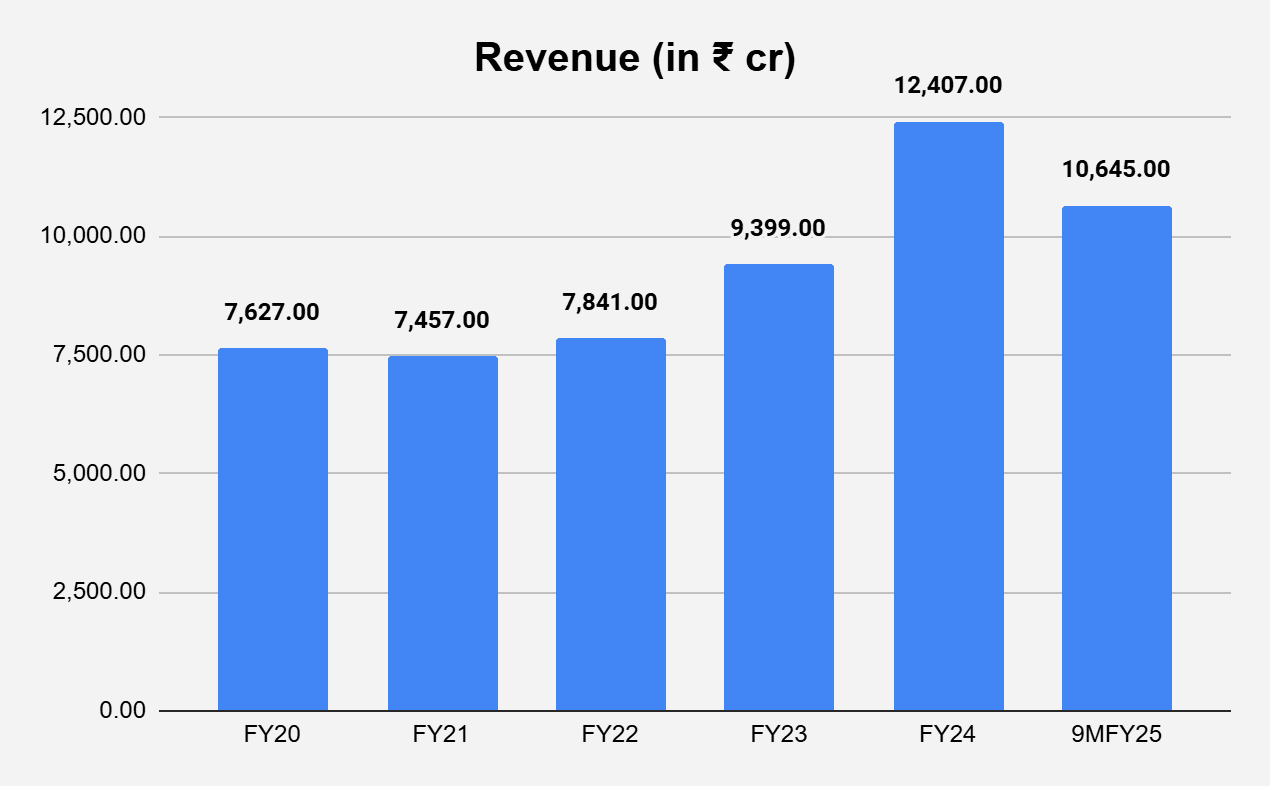

🧮 Financial Overview

Key Financial Ratios (FY25):

- P/E Ratio: ~28x (moderate vs peers)

- Debt/Equity: 0.15 (low leverage)

- ROE: 15.2%

- Dividend Yield: ~1.2%

Voltas maintains a clean balance sheet, moderate valuation, and strong return ratios.

📉 Risks to Watch Out For

Despite its strengths, Voltas faces the following challenges:

1. Seasonal Dependency

- AC and cooling products are heavily dependent on summer demand.

- Unseasonal rains can severely affect revenue, as seen in Q1 FY26.

2. Margin Pressure

- White goods expansion is capex-heavy and drags on overall margins.

- Rising competition leads to aggressive discounting.

3. Regulatory Headwinds

- GST notices, compliance costs, and import duties can disrupt operations.

4. Slow Project Execution

- The EMPS segment often sees delays, especially in overseas markets like the Middle East.

📊 Technical View (As of July 3, 2025)

- Support Level: ₹1,320

- Resistance: ₹1,420

- RSI: 61 (neutral to slightly bullish)

- Moving Averages: Trading above 50-day and 100-day MA; bullish crossover likely

Technical indicators suggest a potential upside breakout, but confirmation depends on Q2 earnings and monsoon performance.

🗣️ Analyst Recommendations

Brokerages have had mixed views in 2025:

- Buy: Motilal Oswal, Sharekhan – citing recovery potential and strong brand

- Hold: ICICI Securities – cautious on Q1 AC volume weakness

- Underweight: CLSA – concerned about margin pressure from Voltas Beko and competition

🧠 FAQs on Voltas Stock

Q1. Why is Voltas stock underperforming in 2025?

Ans: Weak AC sales due to poor summer, competitive pressure, and regulatory issues like the GST notice have weighed on investor sentiment.

Q2. Is Voltas a fundamentally strong company?

Ans: Yes. Strong brand, low debt, and good long-term potential. The current dip may offer a value buying opportunity for long-term investors.

Q3. What is Voltas’ dividend payout?

Ans: The company typically pays a dividend in the range of ₹5–6 per share annually.

Q4. Is Voltas Beko profitable?

Ans: Not yet. It’s still in the investment and expansion phase, likely to turn profitable by FY27.

Q5. Will Voltas benefit from rising heat waves and climate change?

Ans: In the long run, yes. Rising urbanization and warmer summers will increase demand for cooling appliances in India.

✅ Conclusion: Should You Buy Voltas Stock?

Voltas is a Tata Group blue-chip, market leader in ACs, and a brand with high trust. The company is navigating near-term headwinds, but its fundamentals remain solid.

🔹 BUY, if you:

- Are a long-term investor (2–5 years)

- Believe in India’s consumption growth

- Trust Voltas’ leadership in cooling and appliances

⚠️ HOLD / WATCH, if you:

- Are worried about regulatory risks

- Prefer short-term profits

- Want faster growth in high-margin businesses

“Voltas is not just about beating the heat—it’s about staying cool in your portfolio too.”