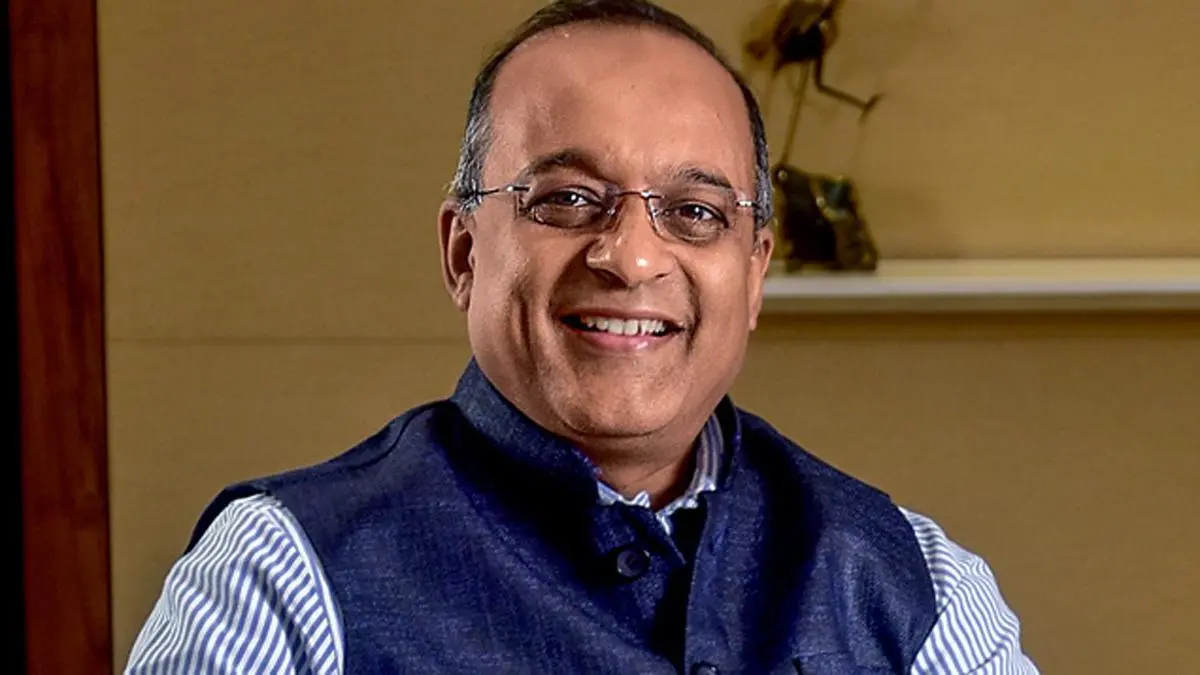

In the dynamic world of Indian banking, few names resonate with the same level of quiet confidence and strategic foresight as Sashidhar Jagdishan, the Managing Director and CEO of HDFC Bank. Since taking over the reins of one of India’s largest private sector banks in October 2020, Jagdishan has not only upheld the legacy of his predecessor Aditya Puri but has also initiated a wave of transformative changes to position HDFC Bank for the digital age.

Early Life and Education

Sashidhar Jagdishan is known as a low-profile, highly analytical leader with deep roots in finance and economics. He holds a Master’s degree in Economics from the University of Mumbai and is also a Chartered Accountant. These academic credentials gave him a strong foundation in both the theoretical and practical aspects of banking and economics.

Before his banking career, Jagdishan worked at Deutsche Bank, where he gained exposure to global financial operations, further shaping his understanding of international banking systems.

Joining HDFC Bank: Climbing the Ranks

Jagdishan joined HDFC Bank in 1996 as a Manager in the Finance department. Over the years, he took on increasing responsibilities and played a pivotal role in shaping the bank’s financial and strategic policies. His consistency, strategic vision, and operational excellence led to his appointment as Chief Financial Officer (CFO) in 2008.

As CFO, he helped the bank navigate through major financial events like the 2008 global recession, India’s economic slowdown in the early 2010s, and policy changes like demonetization and GST rollout.

In 2019, he was elevated to the role of Group Head overseeing functions like finance, HR, legal, secretarial, and CSR. This promotion was widely seen as a grooming phase for the top job, especially with Aditya Puri nearing retirement.

Taking Over as CEO

After Aditya Puri’s legendary 26-year tenure, the RBI approved Jagdishan’s appointment as MD and CEO of HDFC Bank in August 2020, and he officially took charge on October 27, 2020. His appointment marked a generational shift at HDFC Bank.

While Puri was known for his charismatic leadership and aggressive expansion style, Jagdishan brought in a quieter, more data-driven, and people-centric approach.

In his very first letter to shareholders as CEO, he emphasized transparency, digital transformation, customer-centricity, and internal reforms. It was clear that he wanted to take the bank to the next level without compromising on its core values of trust and performance.

Leadership Philosophy

Sashidhar Jagdishan’s leadership style is collaborative, inclusive, and forward-looking. Unlike many high-profile CEOs, he avoids media limelight and focuses more on execution than on optics. He is known for being approachable within the organization, maintaining an open-door policy, and emphasizing employee well-being.

He once remarked, “We need to marry our scale and strength with agility, innovation, and empathy.” This single quote encapsulates his balanced leadership—respecting legacy while embracing disruption.

Digital Transformation: A Key Priority

One of Jagdishan’s most notable contributions is pushing digital transformation at HDFC Bank. Under his leadership, the bank launched a three-year plan called “Project Future Ready”, which focuses on:

- Reinventing digital banking platforms

- Enhancing customer experience through AI and automation

- Expanding digital lending capabilities

- Integrating IT infrastructure post the HDFC-HDFC Bank merger

His tenure also saw the bank face RBI restrictions on digital launches due to repeated outages. Jagdishan accepted responsibility and turned the crisis into an opportunity by overhauling the bank’s IT infrastructure, creating new Centers of Excellence, and bringing in top tech talent.

Today, HDFC Bank’s digital banking is not just catching up with fintech rivals but is also setting benchmarks for security, scalability, and personalization.

The Landmark HDFC-HDFC Bank Merger

Arguably, the biggest move under Jagdishan’s leadership was the merger of HDFC Ltd (the housing finance giant) with HDFC Bank in 2023, creating a financial behemoth with over ₹18 lakh crore in market capitalization.

This merger:

- Combined HDFC’s deep home loan network with the bank’s retail deposit strength

- Enhanced cross-selling opportunities

- Created synergies in treasury and technology

- Expanded customer base significantly

While the merger was structurally complex and involved regulatory hurdles, Jagdishan ensured a smooth and transparent integration, winning accolades from analysts, investors, and the RBI.

Business Growth and Financial Performance

Since Jagdishan took over as CEO, HDFC Bank has seen consistent growth across all verticals. Key metrics under his leadership:

- Net Profit Growth: Double-digit YoY increases, despite market volatility

- Loan Book Expansion: Strong growth in retail, SME, and wholesale lending

- Deposit Base: HDFC Bank continues to dominate in CASA deposits

- NPA Management: Maintained one of the lowest Gross NPAs among private banks

- Shareholder Returns: Despite global economic challenges, the bank’s stock remains a preferred choice for institutional and retail investors

This performance underscores Jagdishan’s ability to balance risk with growth—a crucial trait in the banking sector.

Focus on Sustainability and Inclusion

Jagdishan has also stressed the importance of ESG (Environmental, Social, Governance) principles. Under his leadership:

- HDFC Bank has committed to carbon neutrality by 2031–32

- Launched green financing products

- Expanded financial inclusion programs to rural and semi-urban areas

- Increased CSR spending in education, health, and skill development

He believes that banking should not just be about profits but about nation-building.

Challenges Ahead

While Jagdishan has stabilized and re-energized HDFC Bank, several challenges remain:

- Intensifying Competition from fintechs and other private players

- Technological Disruption and cybersecurity threats

- Global Economic Uncertainty, interest rate cycles, and inflationary pressures

- Regulatory Scrutiny post the merger and digital push

- Cultural Integration of HDFC Ltd employees and systems

However, with his calm demeanor and sharp focus, Jagdishan appears well-prepared to tackle these challenges.

Conclusion: The Right Leader for the Right Time

Sashidhar Jagdishan represents the evolution of HDFC Bank from a legacy institution into a digitally empowered, socially responsible financial powerhouse. His leadership is not defined by grandstanding or flamboyant quotes, but by a deep sense of purpose, integrity, and long-term vision.

As India grows into a $5 trillion economy, banks like HDFC will play a crucial role—and with Jagdishan at the helm, stakeholders can remain confident that the bank is in capable and visionary hands.