When it comes to the world of cryptocurrencies, Ethereum (ETH) is a name that always stands alongside Bitcoin. Launched in 2015 by Vitalik Buterin and his team, Ethereum is more than just a digital currency—it is a decentralized platform for smart contracts and decentralized applications (dApps). Over the past decade, Ethereum has transformed the blockchain space and become the backbone of decentralized finance (DeFi), non-fungible tokens (NFTs), and Web3 development.

As we step into 2025, Ethereum’s price continues to attract the attention of investors, traders, developers, and regulators across the globe. With its highly volatile nature, ETH remains both an opportunity and a risk for those who engage with it. In this blog, we will explore Ethereum’s journey, the factors influencing its price, its comparison with other cryptocurrencies, and the possible future scenarios for its valuation.

Ethereum: A Quick Overview

Before diving into price analysis, it’s important to understand Ethereum’s unique value proposition:

- Smart Contracts: Ethereum introduced programmable contracts that automatically execute when conditions are met.

- dApps & DeFi: Thousands of decentralized applications are built on Ethereum, making it the leading blockchain for DeFi projects.

- NFT Ecosystem: The NFT boom in 2020–2021 was fueled largely by Ethereum’s ERC-721 token standard.

- Transition to Proof-of-Stake (PoS): With the Ethereum 2.0 upgrade (The Merge in 2022), the network shifted from energy-intensive Proof-of-Work (PoW) to PoS, significantly reducing energy consumption and improving scalability.

These fundamentals make Ethereum more than just a cryptocurrency—it is the infrastructure of decentralized innovation.

Ethereum Price History: A Volatile Journey

Ethereum’s price history illustrates the highs and lows of the crypto industry.

- Initial Years (2015–2016): ETH launched at less than $1. Early adopters saw gradual growth as awareness increased.

- First Bull Run (2017): Ethereum surged to around $1,400 during the ICO (Initial Coin Offering) boom, as hundreds of projects launched on its blockchain.

- Crypto Winter (2018–2019): The bubble burst, and ETH crashed below $100, highlighting its volatility.

- DeFi & NFT Boom (2020–2021): The rise of DeFi protocols and NFTs pushed Ethereum to new heights, peaking at $4,800 in November 2021.

- Bear Market (2022): Following global macroeconomic pressures and the collapse of major crypto firms, ETH dropped below $1,000.

- Recovery (2023–2024): With broader market stabilization and institutional adoption, Ethereum gradually recovered, trading in the $1,600–$3,500 range.

This history shows that Ethereum’s price is heavily influenced by market sentiment, adoption trends, and macroeconomic factors.

Key Factors Influencing Ethereum Price

Several factors drive Ethereum’s price in 2025:

1. Network Upgrades and Scalability

Ethereum’s move to Proof-of-Stake and sharding upgrades (Ethereum 2.0 roadmap) are crucial for scalability. Lower transaction fees and faster speeds make Ethereum more attractive, supporting higher demand and potentially boosting ETH price.

2. Adoption in DeFi & NFTs

Ethereum still dominates DeFi and NFTs, despite competition from blockchains like Solana, Avalanche, and Polygon. If developers and users continue to favor Ethereum, the demand for ETH (used for gas fees) will remain high.

3. Institutional Investment

Large financial institutions are increasingly exploring Ethereum as both a digital asset and an infrastructure layer. The approval of Ethereum ETFs in some regions has also increased accessibility, positively affecting price.

4. Macroeconomic Conditions

Interest rates, inflation, and global financial stability directly influence crypto markets. During uncertain times, investors often exit risky assets like ETH, while favorable conditions bring in new capital.

5. Competition from Other Blockchains

Rivals like Solana, Cardano, and Polkadot are constantly innovating. If Ethereum loses dominance due to scalability issues, its price growth could be capped.

6. Regulation

Governments worldwide are debating how to regulate cryptocurrencies. A favorable regulatory environment would attract more institutional investment, while harsh restrictions could suppress Ethereum’s price.

Ethereum Price in Comparison to Bitcoin

Ethereum and Bitcoin are often compared as the two largest cryptocurrencies:

| Feature | Bitcoin (BTC) | Ethereum (ETH) |

|---|---|---|

| Launch Year | 2009 | 2015 |

| Purpose | Digital currency & store of value | Smart contracts & decentralized applications |

| Consensus | Proof-of-Work → PoS (Lightning Network support) | Proof-of-Stake (post-Merge) |

| Supply Cap | 21 million | No fixed supply cap |

| All-Time High | ~$69,000 (Nov 2021) | ~$4,800 (Nov 2021) |

Bitcoin is viewed as “digital gold,” while Ethereum is seen as the foundation for Web3. Ethereum’s utility in real-world applications gives it growth potential, but its unlimited supply may influence long-term price compared to Bitcoin’s scarcity-driven model.

Ethereum Price Trends in 2025

Ethereum’s performance in 2025 reflects several ongoing market trends:

- Increased Institutional Adoption: With Ethereum ETFs gaining traction, more traditional investors have entered the ETH market.

- Rise of Layer-2 Scaling Solutions: Platforms like Arbitrum, Optimism, and zkSync are reducing gas fees, making Ethereum more usable. This encourages more transactions, thereby increasing ETH demand.

- Staking Demand: Since Ethereum’s shift to PoS, ETH holders can stake their coins for rewards. This reduces liquid supply in the market, potentially creating upward price pressure.

- AI & Web3 Growth: The integration of blockchain with artificial intelligence, gaming, and decentralized identity projects often happens on Ethereum, further boosting demand.

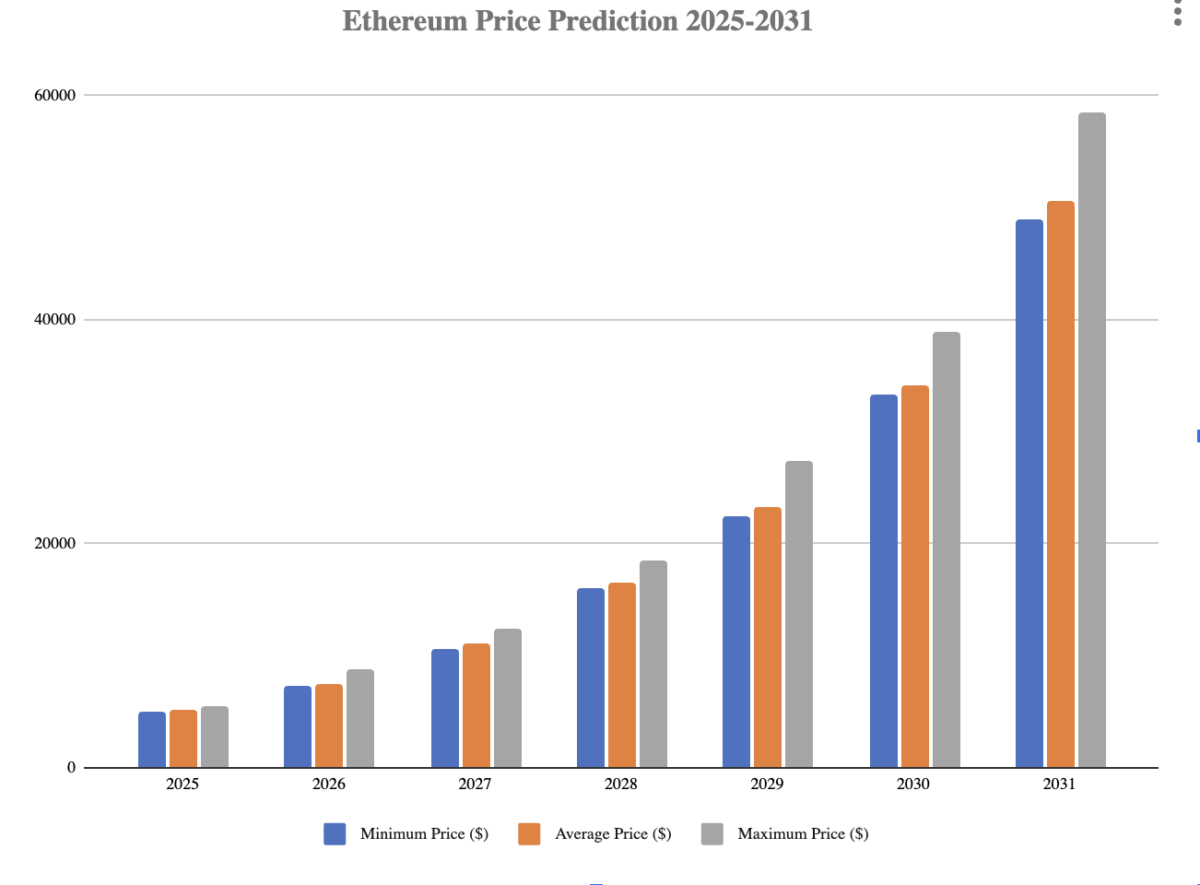

Ethereum Price Predictions

Price predictions in crypto are highly speculative, but analysts and market watchers have made projections for Ethereum in 2025 and beyond:

- Bullish Scenario: If Ethereum maintains its dominance in DeFi, NFTs, and institutional adoption, ETH could trade between $5,000–$7,000 by the end of 2025.

- Moderate Scenario: If adoption continues steadily but competition increases, ETH may stabilize in the $3,000–$4,500 range.

- Bearish Scenario: If regulatory crackdowns or scalability issues persist, Ethereum could drop below $2,000 again.

Long-term, some analysts believe ETH could surpass its all-time high and move toward $10,000–$15,000 by 2030, provided the network remains the leading smart contract platform.

Challenges Ethereum Faces

While Ethereum’s potential is immense, it faces certain obstacles:

- High Transaction Fees: Despite Layer-2 solutions, high gas fees remain a concern during peak activity.

- Scalability: Ethereum must fully implement sharding to handle mass adoption.

- Competition: Blockchains like Solana offer faster speeds and lower fees, attracting developers.

- Regulatory Uncertainty: Classification of Ethereum as a security in some jurisdictions could complicate its growth.

- Market Volatility: Like all cryptocurrencies, Ethereum remains subject to sharp price swings, making it risky for short-term traders.

Ethereum as an Investment

For investors, Ethereum presents both opportunities and risks:

- Opportunities:

- Strong developer ecosystem.

- Continuous innovation (Layer-2, sharding, staking).

- Growing institutional support.

- Real-world applications in DeFi, NFTs, and Web3.

- Risks:

- High volatility and market crashes.

- Intense competition from alternative blockchains.

- Uncertain regulations across different countries.

Thus, Ethereum can be seen as a long-term investment asset for those who believe in blockchain technology, though diversification remains essential.

Future Outlook

The future of Ethereum depends on how well it addresses scalability, competition, and regulation. Potential developments include:

- Mainstream Adoption of dApps: If decentralized applications on Ethereum become as popular as traditional apps, ETH demand will skyrocket.

- Global Financial Integration: If more governments and banks adopt Ethereum-based solutions, it could become a standard for digital finance.

- Technological Innovations: Continued upgrades like Danksharding and Layer-2 improvements will make Ethereum more efficient and cost-effective.

Conclusion

Ethereum’s journey from under $1 in 2015 to thousands of dollars today shows its incredible growth and resilience. As we analyze the Ethereum price in 2025, it becomes clear that ETH is not just a speculative asset but a key driver of the decentralized digital economy.

While challenges like scalability, fees, and regulation remain, Ethereum’s strong developer ecosystem, institutional adoption, and real-world utility give it long-term potential. Whether ETH trades at $3,000, $5,000, or even higher, one thing is certain—Ethereum will continue to play a central role in shaping the future of finance, technology, and the internet itself.

For investors, Ethereum remains both a high-risk and high-reward opportunity. With careful strategy and long-term vision, ETH could prove to be one of the most valuable assets in the digital age.