The Dow Jones Industrial Average (DJIA)—an iconic indicator of American economic health—has shown signs of strength, volatility, and resilience in 2025. As of early July, the Dow is trading around 44,400 points, reflecting a modest 4–5% gain year-to-date. But behind this seemingly steady performance lies a complex mix of market optimism, geopolitical tensions, and economic uncertainty.

This blog takes a deep dive into the Dow Jones’ performance, key drivers shaping the U.S. stock markets, sector highlights, and what investors can expect in the months ahead.

🕰️ A Quick Recap: What is the Dow Jones?

The Dow Jones Industrial Average is one of the oldest and most closely watched stock indexes in the world. Comprising 30 major U.S. companies, the DJIA represents a diverse mix of industries—from tech and finance to healthcare and retail.

Some of the heavyweights on the Dow include:

- Apple Inc.

- Goldman Sachs

- Boeing

- Johnson & Johnson

- Microsoft

- Nike

- Walmart

Although it does not include every leading U.S. company (like many in the Nasdaq), the DJIA is considered a bellwether of the American economy and investor sentiment.

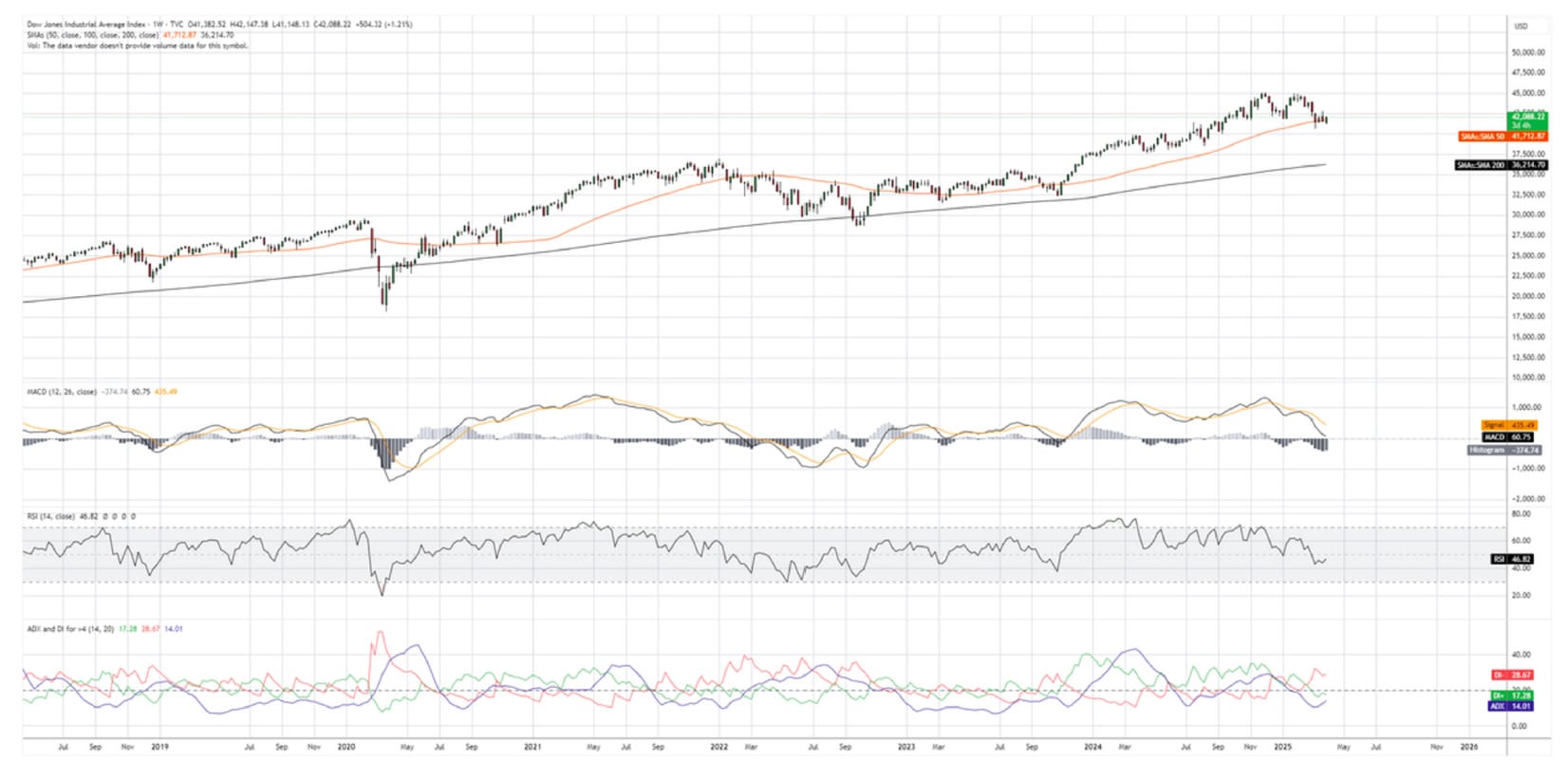

📈 Dow’s Performance in 2025 (YTD)

✅ Strong Start, Then Turbulence

- The Dow opened 2025 with positive momentum, building on the strength of late 2024.

- However, in February and March, geopolitical developments—especially tensions in the Indo-Pacific and U.S.-China trade rhetoric—triggered a mild market correction.

- By April, signs of inflationary control and strong job data helped the Dow regain losses.

- As of July 8, 2025, the Dow is trading around 44,400–44,500 points, up ~4.5% year-to-date.

🏆 Best-Performing Stocks on the Dow (H1 2025)

- Nvidia: Continued to dominate due to the AI revolution.

- Goldman Sachs: Financials rebounded strongly with Fed easing expectations.

- Nike: Surged due to strong global sales and return of consumer spending.

📉 Underperformers

- Boeing: Continued production and regulatory setbacks.

- 3M: Ongoing legal issues and supply chain challenges.

- Verizon & AT&T: Telecom sector remains sluggish due to debt and low margins.

🌎 July 2025 Market Volatility: What’s Causing the Swings?

1. Tariff Threats & Political Noise

- A major market shakeup occurred on July 7, when former President Donald Trump floated new tariff proposals on Chinese goods.

- The Dow dropped over 500 points that day in response, showing how sensitive investors remain to trade war fears.

- Though no new tariffs have been imposed, the political uncertainty is enough to unnerve markets.

2. Federal Reserve’s Rate Stance

- The Federal Reserve, after raising rates aggressively in 2022–2023, has now pivoted to a more dovish tone.

- Inflation has cooled closer to the 2% target, giving the Fed space to hold or even cut rates later this year—a positive sign for equities.

3. Strong Jobs Report

- The June 2025 jobs report showed unexpected strength, with the economy adding over 300,000 jobs.

- Unemployment dropped to 3.5%, supporting consumer demand and corporate earnings forecasts.

📊 Sector-Wise Breakdown

🔌 Technology

- Still the leading driver of market growth.

- AI, semiconductor, and cloud computing companies continue to report strong earnings.

- Dow components like Microsoft and Intel are gaining from enterprise AI demand.

🏥 Healthcare

- Defensive sector gains in times of volatility.

- Johnson & Johnson and UnitedHealth offer stability with modest growth.

💰 Financials

- Banks like JPMorgan and Goldman Sachs are performing well as interest rate cuts could boost lending activity.

🚘 Industrials

- Mixed performance. Companies like Caterpillar are stable, but Boeing continues to underperform.

💹 How the Dow Compares to S&P 500 & Nasdaq

| Index | YTD Return (July 2025) | Key Drivers |

|---|---|---|

| Dow Jones | +4.5% | Blue-chip stability, finance recovery |

| S&P 500 | +7.8% | Broader market rally, tech + healthcare |

| Nasdaq | +10.2% | AI-driven tech surge |

Nasdaq is leading the pack thanks to explosive gains in AI, software, and chip stocks, while the Dow’s slower growth reflects its exposure to more traditional industries.

🔮 Dow Jones Outlook for H2 2025

🧭 Bullish Signals

- Easing inflation and interest rate cuts could drive stocks higher.

- Consumer demand remains strong in the U.S. and globally.

- If political stability is maintained post-election cycle, foreign investment may increase.

⚠️ Risks to Watch

- Geopolitical Tensions: Any escalation in Taiwan, Middle East, or Russia-Ukraine could trigger sell-offs.

- Tariff War: Even threats of trade barriers can impact supply chains and investor confidence.

- Corporate Debt: High borrowing during the low-rate years could hurt companies if cash flow weakens.

🗣️ What Analysts Are Saying

“The Dow is slowly grinding higher, but without the same flash as the Nasdaq. It’s a safer play for long-term investors looking for dividends and less volatility.”

— Lori Calvasina, RBC Capital Markets

“July’s dip was a healthy correction. We still see the Dow ending 2025 in the 47,000–48,000 range.”

— Jonathan Golub, UBS

📚 Investment Strategy for 2025

💼 For Long-Term Investors

- Stick with high-quality dividend stocks on the Dow.

- Look for value opportunities in underperforming sectors like industrials and healthcare.

🚀 For Growth-Focused Traders

- Use corrections to enter tech and finance names.

- Keep an eye on AI-linked firms and cyclical sectors benefiting from economic expansion.

🧾 Final Thoughts

The Dow Jones Industrial Average remains a powerful indicator of U.S. economic health and corporate performance. While 2025 has so far been a year of cautious optimism, a mix of macroeconomic shifts, political drama, and global uncertainty keeps markets on their toes.

As always, a diversified strategy, regular rebalancing, and a close eye on macro trends can help investors navigate the ups and downs of Wall Street.

Did you find this blog helpful? Share it with fellow investors and leave your thoughts in the comments below!